Understanding Canada's Medical Supply Warehousing Landscape

Imagine the Canadian warehousing scene as a vast, intricate network, far more than just rows of shelves and forklifts. It's a dynamic system of interconnected hubs, each playing a critical role in the efficient flow of goods, especially vital medical supplies. For US medical manufacturers, understanding this network is like having the key to unlocking significant growth opportunities within the Canadian market, particularly in Quebec.

This growth isn't happening in a vacuum. It's fueled by several converging forces, including the ever-increasing demands of the Canadian healthcare system and the distinct advantages offered by cross-border trade. The Canadian warehousing market itself is experiencing a period of remarkable expansion. It's projected to reach USD 59.5 billion in 2024 and surge to a remarkable USD 92.9 billion by 2030. This impressive growth, driven by a CAGR of 7.7% between 2025 and 2030, underscores the sector's crucial importance to the Canadian economy. Want to delve deeper into this growth? Check out this insightful analysis: Canadian Warehousing Market Expansion. This expansion creates a fertile ground for US medical manufacturers seeking to efficiently reach Canadian consumers. Effective inventory management is paramount for success in Canadian warehousing. For those interested in optimizing their inventory strategies, this resource might be helpful: Inventory Optimization with Data Intelligence.

Quebec: Your Strategic Gateway

Quebec isn't just another province on the map; it's a strategic entry point into the Canadian healthcare system. Think of it as the ideal starting point for your Canadian expansion journey. This system places a premium on quality, innovation, and strong partnerships. It rewards manufacturers who take the time to understand its unique characteristics, from bilingual labeling requirements to the cultural nuances that influence purchasing decisions. Establishing a distribution foothold in Quebec provides a springboard for broader expansion across Canada and potentially into global markets.

This graph provides a visual representation of the projected growth within the Canadian warehousing market, broken down by type. It emphasizes the growing need for specialized warehousing, including temperature-controlled facilities like cold storage, which are essential for many medical supplies. This reinforces the strategic importance for US medical manufacturers of securing the right warehousing solutions in Canada. For those exploring different warehousing services, this article offers a helpful overview: 5 Essential Warehousing Services Offered by Waff Logistics.

Streamlining Costs, Unlocking New Revenue

Forward-thinking US manufacturers are strategically using warehousing in Canada to optimize their North American distribution costs and tap into fresh revenue streams. By strategically placing inventory within Canada, they shrink shipping times and expenses for Canadian customers, gaining a competitive edge and boosting customer satisfaction.

Having a Canadian presence allows for quicker responses to market fluctuations, increasing market share and strengthening brand recognition. This streamlined approach empowers US manufacturers to compete effectively with domestic Canadian suppliers while also potentially serving as a distribution hub for other international markets.

Let's take a closer look at the projected growth of the Canadian warehousing market with this table:

Canadian Warehousing Market Growth Projection Market revenue comparison showing growth trajectory and key segments

| Year | Market Revenue (USD Billion) | Growth Rate (%) | Leading Segment |

|---|---|---|---|

| 2024 | 59.5 | - | General Warehousing |

| 2025 | 64.2 | 7.9 | General Warehousing |

| 2026 | 69.4 | 8.1 | General Warehousing |

| 2027 | 75.1 | 8.2 | General Warehousing |

| 2028 | 81.3 | 8.2 | General Warehousing |

| 2029 | 88.1 | 8.3 | General Warehousing |

| 2030 | 92.9 | 7.7 | General Warehousing |

This table illustrates the consistent growth expected in the Canadian warehousing market. While general warehousing remains the dominant segment, the consistent growth rate signifies opportunities for specialized services, including those catering to medical supplies. This data reinforces the potential for US medical manufacturers to capitalize on the expanding Canadian market by establishing a strategic warehousing presence.

Cold Chain Excellence: Protecting Your Medical Products Every Step

Shipping temperature-sensitive medical products from the US to Quebec? It's not as simple as loading a truck and hitting the road. Think of it like transporting a prized orchid – it needs a very specific environment to survive the trip. Similarly, pharmaceuticals and other medical supplies need careful temperature control and specialized handling within the cold chain. This network of temperature-controlled storage and distribution ensures product viability and, ultimately, patient safety. For US manufacturers, understanding the Canadian cold chain is essential for serving the Quebec healthcare market.

This diagram shows the different stages of a typical cold chain, highlighting how crucial consistent temperature control is. From the manufacturing facility all the way to the healthcare provider, each step is vital for preserving the quality of temperature-sensitive goods. Every link in the chain is a potential point of failure where temperature fluctuations can occur, demanding careful management.

Temperature-Sensitive Distribution: Real-World Applications

Imagine a US pharmaceutical company shipping insulin to Quebec. Maintaining the correct temperature isn’t just a good idea, it’s a legal requirement, and absolutely critical for the medication to work. Specialized cold storage warehousing in Canada, ideally situated near major transportation hubs, becomes indispensable for smooth delivery.

This means working with Canadian warehousing providers who understand the specific needs of handling pharmaceuticals and other medical products. They should offer robust temperature-controlled storage and handling solutions. This proactive approach ensures product quality and avoids expensive losses due to temperature deviations.

Canadian Cold Storage: Advanced Monitoring

Many Canadian cold storage facilities use advanced monitoring technologies. These systems act like a team of dedicated sentinels, constantly monitoring temperature and humidity levels. Real-time data and alerts allow for proactive adjustments, making sure your products stay within the required temperature range.

This constant oversight gives US manufacturers peace of mind, knowing their valuable products are protected throughout the entire supply chain.

Reducing Costs Through Proper Cold Chain Management

Specialized cold chain warehousing might seem like an extra cost, but it's actually a smart investment. Imagine the financial hit a US manufacturer would take if a shipment of temperature-sensitive vaccines spoiled in transit. Proper cold chain management minimizes such risks, reducing product loss and extending shelf life.

This leads to better profits and stronger relationships with customers.

Meeting Health Canada Requirements: A Gateway to Success

Meeting Health Canada's strict requirements is non-negotiable for entering the Canadian healthcare market. Compliance not only shows your commitment to quality and safety but also unlocks access to valuable contracts and long-term partnerships within the Quebec healthcare system. It's like getting a stamp of approval, building trust with potential clients and strengthening your market position.

By following these regulations, US manufacturers can establish themselves as reliable suppliers, building confidence and integrating smoothly into the Canadian healthcare landscape. This sets them up for sustainable growth and long-term success in the Canadian market. This attention to detail ultimately strengthens their brand and fosters trust within the Quebec healthcare community.

Cracking the Quebec Code: Your Gateway to Canadian Healthcare

Quebec offers a unique entry point for US medical manufacturers looking to break into the Canadian warehousing scene. It's not just another market; think of it as a VIP entrance to a healthcare system that values quality, innovation, and solid partnerships. It's like finding a group of customers who truly appreciate businesses that take the time to understand their specific needs. This understanding can be the key to unlocking serious growth.

This screenshot from Wikipedia gives you a glimpse into Quebec's publicly funded healthcare system, showing its structure and what it covers. The image highlights the universal nature of healthcare in the province, which translates to a big opportunity for US medical manufacturers. This all-encompassing system, with its focus on public access, creates consistent, high demand for medical supplies.

Navigating Quebec's Distinctive Requirements

Doing business in Quebec means understanding the local landscape. For example, bilingual labeling isn't just about translating words; it's about making sure your message resonates culturally. US manufacturers also need to be aware of how Quebec's purchasing processes might differ from those back home. These differences can give a real advantage to companies willing to adapt. Knowing the specific needs of Quebec's healthcare networks—things like language preferences and product specs—can give manufacturers a leg up on the competition.

Economic Incentives and Strategic Advantages

Quebec offers enticing economic incentives to medical supply companies. These can include tax breaks and grants for research and development. Having a distribution center in Quebec also offers strategic benefits. It allows manufacturers to respond faster to market needs and provide more localized service. This improved responsiveness helps build stronger ties with Quebec healthcare providers.

Quebec as a Launching Pad

Think of Quebec as a stepping stone to wider Canadian and even international expansion. By establishing a solid presence in this strategically located province, US manufacturers gain access to effective distribution networks. This makes it easier to reach other Canadian markets and potentially turn Quebec into a central hub for reaching global markets.

Positioning Your Products for Success

Breaking into the Quebec healthcare market takes a well-defined plan. Identifying key healthcare networks in Quebec and tailoring your products to their particular requirements is essential. This means understanding their procurement procedures, preferred product formats, and specific clinical needs. This targeted approach helps boost market penetration and positions products for maximum impact. For instance, emphasizing features that align with Quebec's healthcare priorities, like cost-effectiveness or innovative solutions, can be a big selling point to decision-makers.

Finding Your Perfect 3PL Match: A Partnership That Drives Growth

Choosing a 3PL partner in Canada isn't a simple task. It's more like selecting the right surgical instrument – precision and dependability are absolutely essential. For a US medical manufacturer selling into Quebec, your 3PL partner is practically an extension of your own team, directly influencing your success. The right partnership can be a springboard into the market, while the wrong one can cause expensive delays and regulatory nightmares. This is especially true for medical supplies, which often require specialized handling, adhere to strict regulations, and may be temperature-sensitive.

Key Considerations For Medical Manufacturers

When you're evaluating potential 3PL providers for warehousing in Canada, prioritize those with a proven track record handling medical supplies. Look for partners who understand the ins and outs of Health Canada regulations and have solid quality management systems in place. Ask about their experience with temperature-sensitive products and their cold chain capabilities. This expertise is vital to preserving the integrity of your products and ensuring you comply with all Canadian regulations.

A deep understanding of cross-border logistics is also critical. Your 3PL partner should be skilled in navigating the complexities of US-Canada trade, including customs procedures and documentation. For US-based manufacturers serving the Quebec market, this expertise can significantly shorten transit times and smooth out potential delays. For more on this, you might find this interesting: Efficient Cross-Docking Service.

Evaluating 3PL Capabilities

Don't be fooled by fancy presentations. Focus on asking targeted questions that uncover a 3PL provider's true strengths and weaknesses. Ask about their warehouse technology, their inventory management systems, and how they handle order fulfillment. Discuss their security protocols and how they manage risk. These conversations offer valuable insights into how efficiently they operate and how committed they are to quality. It's also smart to ask about their specific experience working with US-based manufacturers and their understanding of the Quebec healthcare market's unique requirements.

The Canadian 3PL warehouse market plays a significant role in North American logistics. By 2025, the market is projected to reach USD $2.14 billion, assuming Canada comprises about 10% of the North American 3PL market. This conservative estimate reflects Canada's economic strength and well-developed logistics infrastructure. Discover more insights into the Canadian 3PL market.

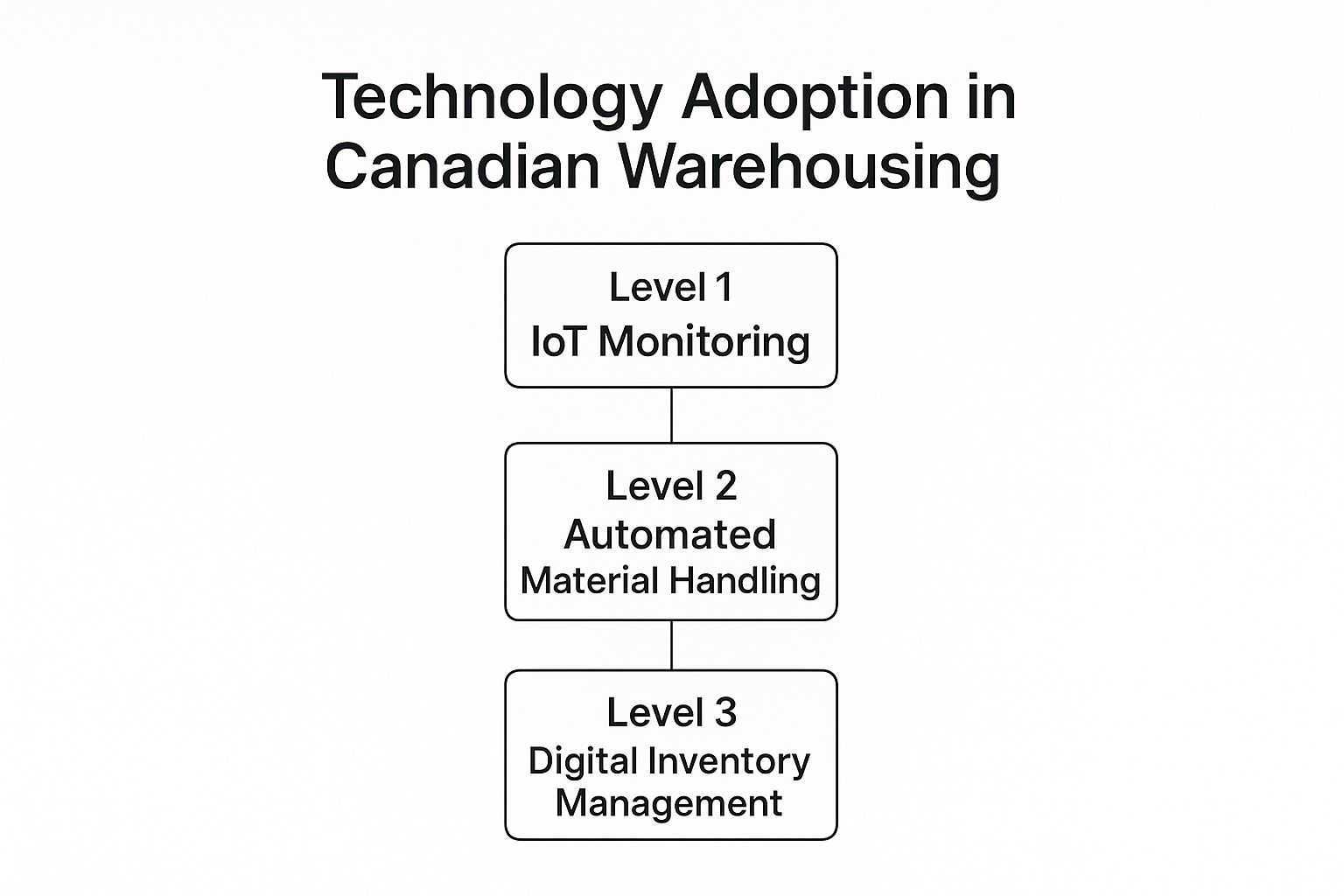

This infographic shows how Canadian warehouses are adopting technology in stages, from basic IoT monitoring to automated material handling and, finally, digital inventory management. It shows how these technologies connect and how they are gradually being implemented across the sector. As technology becomes more integrated, warehouse operations become more efficient, accurate, and responsive.

Before we dive into 3PL models, let's look at some criteria you should consider when selecting a 3PL partner, specifically for medical supplies. The table below outlines key factors, their importance, crucial questions to ask, and potential warning signs.

The following table provides a framework for evaluating 3PL partners specializing in medical supply warehousing.

3PL Partner Evaluation Criteria for Medical Supplies

| Criteria | Importance Level | Key Questions | Red Flags |

|---|---|---|---|

| Health Canada Compliance | High | What certifications do you hold? Describe your quality management system. | Lack of necessary certifications, vague or evasive answers regarding compliance procedures. |

| Temperature-Controlled Storage | High | What types of temperature-controlled storage do you offer? Describe your cold chain management process. | Limited temperature-control options, inadequate cold chain equipment, lack of experience with temperature-sensitive products. |

| Security & Risk Management | High | What security measures are in place at your facilities? What is your disaster recovery plan? | Insufficient security measures, absence of a clear disaster recovery plan, history of security breaches. |

| Cross-Border Expertise | High | What is your experience with US-Canada customs and trade regulations? | Limited experience with cross-border logistics, unclear understanding of relevant regulations. |

| Technology & Systems | Medium | What warehouse management system (WMS) do you use? Do you offer real-time inventory tracking? | Outdated technology, manual processes, inability to provide real-time visibility into inventory. |

| Scalability & Flexibility | Medium | Can your services scale to accommodate our future growth? What is your process for handling unexpected demand surges? | Limited storage capacity, inflexible contracts, inability to adapt to changing needs. |

| Pricing & Contract Terms | Medium | What are your pricing structures? What are the terms of your contracts? | Unclear or complex pricing, rigid contract terms, hidden fees. |

This table helps you focus on the essential aspects of a 3PL partnership for medical supplies. Asking these key questions and watching out for red flags can save you from costly mistakes down the line.

3PL Models and Agreements

Different 3PL models offer varying levels of service and control. Dedicated warehousing gives you exclusive use of a facility, offering maximum control but often at a higher price. Shared warehousing is a more budget-friendly option, but you might have to compromise on customization. Cross-docking emphasizes rapid product movement, making it ideal for time-sensitive goods. The best model for you depends on your specific product needs and overall business goals.

When creating your 3PL agreement, prioritize clarity and flexibility. Make sure the contract clearly defines service levels, performance metrics, and pricing. Include provisions for scalability and growth so you can adapt to changes in your business. A well-crafted agreement protects your interests and fosters a collaborative partnership that benefits both parties. Choosing a 3PL partner is a strategic decision. By focusing on experience, asking the right questions, and building a strong partnership, US medical manufacturers can create a reliable and efficient distribution network in Canada, opening up opportunities for growth in the Quebec market and beyond.

Technology That Works: Digital Systems for Medical Supply Excellence

Managing a medical supply warehouse these days requires pinpoint accuracy and up-to-the-minute information. If you're a US manufacturer working with Quebec, technology isn't just helpful—it's the foundation of your Canadian operations. Imagine a crystal-clear digital dashboard, showing your entire supply chain from your US headquarters all the way to a Quebec hospital. That's the potential of a robust warehouse management system (WMS).

Advanced WMS Capabilities in Canadian Warehouses

Canadian warehouses are using advanced WMS features designed for medical supply distribution. Think of these systems as your digital eyes and ears inside the warehouse, constantly tracking and managing every item. This enables accurate lot tracking, crucial for complying with both FDA and Health Canada regulations.

Automated compliance reporting also simplifies regulatory management, making it easier to show you're meeting standards. Imagine generating detailed compliance reports effortlessly, freeing up your time and reducing administrative work. This lets you concentrate on what's most important—getting vital medical supplies to patients.

The image below gives you a snapshot of a typical WMS and its modules, ranging from inventory control and order management to labor management and reporting.

This overview shows how comprehensive a WMS can be. Every module plays a role in a more efficient and accurate operation, affecting everything from receiving and putting away items to picking, packing, and shipping.

Streamlining Cross-Border Operations

The right technology can greatly improve operations across the border. Imagine less manual data entry, fewer errors, and faster shipping. A well-integrated WMS delivers these benefits, providing real-time visibility into your Canadian operations right from your US office. This lets you monitor inventory, track shipments, and manage your entire supply chain with precision.

Reducing manual tasks also lowers the risk of errors that can lead to expensive recalls. Imagine avoiding the financial hit and damage to your reputation from a recall, all thanks to a reliable WMS. This increased accuracy builds confidence in your operations and strengthens your relationships with Quebec healthcare providers.

Warehouse management systems are becoming essential for logistics across Canada. The market for these systems is expected to grow at a 16.6% CAGR from 2025 to 2030. This growth underscores how important technology is for smooth warehouse operations, precise inventory management, and efficient supply chains across the country. Discover more insights into the Canadian WMS market.

Emerging Technologies: Shaping the Future of Warehousing

Canadian warehouses are adopting new technologies at a rapid pace. IoT sensors provide constant monitoring of environmental factors, ensuring product quality for supplies sensitive to temperature. Blockchain increases transparency in the supply chain, creating a permanent record of each product's journey from start to finish.

And AI-powered analytics help optimize inventory and distribution routes, predicting demand and boosting efficiency. Imagine forecasting changes in demand with remarkable accuracy and adjusting inventory to match, minimizing storage costs and ensuring product availability. These advancements are reshaping warehousing in Canada, opening up new possibilities for US manufacturers to thrive in the Quebec market.

Evaluating Technology Capabilities When Selecting Partners

When you're choosing a Canadian warehousing partner, carefully consider their technology. Don't be fooled by fancy demos; look for practical uses and proven track records. Ask about their WMS features, how well it integrates with your existing systems, and their experience with new technologies. Understanding how their technology fits your specific needs is key to a good partnership and a strong return on your investment. It's not about chasing the newest trends, but picking solutions that directly improve your profits and the service you offer your Quebec clients.

Mastering Cross-Border Compliance: From FDA to Health Canada

This screenshot shows the homepage of Health Canada. Notice the prominent placement of topics like food safety, drugs, and medical devices. This highlights the strict rules US medical manufacturers face when entering the Canadian market. Understanding these regulations is essential for successful warehousing in Canada.

Distributing medical supplies from the US to Canada, especially Quebec, requires understanding both US FDA and Health Canada regulations. It's like needing two keys to open two connected, but different, doors. Both agencies prioritize patient safety, but their specific rules and paperwork can vary quite a bit. For US medical manufacturers, understanding these dual regulations isn't just about avoiding fines. It's about building a smooth, dependable system that helps your business in both markets.

Understanding the Key Differences

Both the FDA and Health Canada aim for product safety and effectiveness, but their methods and documentation differ. For instance, Health Canada emphasizes Medical Device Licensing, requiring detailed device classification and thorough testing. This process is different from FDA premarket approval or 510(k) clearance, requiring careful planning from US manufacturers.

Health Canada also has specific rules for labeling and packaging, including bilingual labeling (English and French) for products sold in Quebec. This goes beyond simple translation. It involves understanding cultural nuances and ensuring the messaging connects with the Quebec market.

Building a Dual-Compliance Quality Management System

Good quality management is key to navigating both regulatory systems. Imagine a well-oiled machine with every part working together smoothly. Your quality system should incorporate both FDA and Health Canada rules, minimizing redundancy and streamlining your operations.

This might involve integrating specific Health Canada documents, like the Medical Device Licence Application, into your existing FDA-compliant quality system. This combined approach allows for efficiently managing both sets of rules, reducing administrative work and potential compliance problems.

Serialization and Traceability: Emerging Requirements

New rules around serialization and traceability are changing how medical supplies are distributed. Think of it as a digital fingerprint for each product, allowing you to track it from your US facility to a patient in Quebec. These tracking systems improve supply chain security, reduce counterfeiting, and make recalls easier to manage. Adopting these standards early can position your company as a preferred supplier for Canadian healthcare organizations. For more on choosing a logistics partner, see: Why You Should Choose Waff as Your Logistics Solutions Partner.

Proactive Compliance: Turning Challenges Into Advantages

Addressing compliance proactively gives US manufacturers a real advantage in the Canadian market. It's like building a strong bridge directly to Quebec's healthcare providers. Meeting or exceeding Health Canada’s standards shows your commitment to quality and builds trust with Canadian customers.

This proactive approach makes market entry easier, speeds up product approvals, and lowers the risk of costly delays or regulatory headaches. It’s not just about meeting the minimum; it's about exceeding expectations and showing your dedication to the Canadian market.

Audits and Inspections: Navigating the Process

Both the FDA and Health Canada conduct regular audits and inspections. Think of a detailed inspection of your warehouse, ensuring everything is stored correctly and documented properly. Knowing how to prepare for and handle these inspections is vital.

For US manufacturers, this means working closely with your Canadian warehousing partners. This ensures all documentation is readily accessible and all processes meet both FDA and Health Canada’s rules.

By understanding the details of each regulatory system, US medical manufacturers can effectively navigate the cross-border landscape. Mastering these details strengthens your position in the Quebec market, expands your reach across Canada, and shows your commitment to providing top-quality medical supplies. This investment in compliance leads to long-term growth, better partnerships, and a strong reputation within the Canadian healthcare system.

Strategic Location Selection: Maximizing Your Canadian Investment

Choosing the right warehouse location in Canada is a big deal. Think of it like choosing the perfect spot for a retail store – it's not just about finding an empty building. It's about setting yourself up for success in the Canadian market. This is especially important for US medical manufacturers supplying Quebec, where things like being close to healthcare networks, smooth cross-border logistics, and access to the rest of Canada really matter.

Economic Factors Influencing Location Decisions

Some Canadian locations are especially attractive for medical supply warehousing, and that comes down to a few key factors. Government incentives, particularly those aimed at healthcare companies, can make a real difference to your bottom line. Some provinces offer tax breaks, grants, and other programs to attract healthcare investment. These incentives can help with initial setup costs and lower your operating expenses.

Infrastructure also plays a vital role. Good transportation networks – highways, railways, and ports – are essential for efficient distribution. Locations with up-to-date infrastructure can cut down on transportation costs and speed up delivery, which is critical for time-sensitive medical supplies. A well-maintained infrastructure network, like the one shown in this overview of Canadian transportation, can really streamline your operations and cut lead times.

This image shows Canada's extensive transportation network, including roads, rail, and sea routes. The density of the network, especially in the more populated southern regions, offers real logistical advantages for US medical manufacturers. Choosing the right spot within this network can minimize transit times and maximize access to key markets like Quebec.

Cost-Benefit Analysis: Beyond Initial Setup Expenses

When you're comparing warehouse locations, don't just look at the initial price. A thorough cost-benefit analysis is essential. Think about the total cost of ownership, which includes things like operating expenses, labor costs, and compliance expenses.

Hidden costs can have a big impact on profitability. For example, the cost of specialized labor for handling medical supplies might be higher in some areas. Compliance auditing expenses can also vary depending on the location and specific regulations. Factoring these considerations into your decision is key. Navigating regulations is vital; you need to ensure your business is compliant.

Cross-Border Logistics Advantages

Well-chosen locations in Canada can offer significant cross-border advantages for US medical manufacturers. Being close to the US border streamlines transport, cutting both time and costs. Some locations also provide access to preferential trade agreements, which simplifies moving goods across the border.

By optimizing your Canadian warehousing strategy, you can potentially reduce your overall North American distribution costs and improve service to both Canadian and US customers. This lets you serve Quebec more efficiently and opens doors to other Canadian markets.

Quebec: Your Strategic Gateway

Quebec’s healthcare market is full of opportunities for US medical manufacturers. Setting up warehousing in or near the province can significantly shorten shipping times and make you more responsive to local demand.

Being close to your customers can give you a real edge, especially for time-sensitive medical supplies. It also strengthens your relationships with Quebec healthcare providers by ensuring faster, more reliable deliveries.

By considering these factors, US medical manufacturers can choose the best warehouse location in Canada. This strategic decision lays the foundation for successful expansion into Quebec and sets your business up for long-term growth in the Canadian market.

Learn more about how Waff Logistics Inc. can help you navigate warehousing in Canada

Article created using Outrank